Latest Home Loan Packages

- as of 30-Jun-2023

- 1m SORA=3.75%

- 3m SORA=3.65%

Package 1

Floating

-

4.2%

3m SORA+0.55% - 4.2%

3m SORA+0.55% -

4.45%

3m SORA+0.8% -

4.65%

3m SORA+1% -

4.65%

3m SORA+1%

Min. loan 500k

Package 2

Fixed

-

3.50%

- 3.50%

-

4.65%

3m SORA+1% - 4.65%

3m SORA+1% - 4.65%

3m SORA+1%

Package 3

Fixed

-

3.50%

-

3.50%

- 3.50%

- 4.65%

3m SORA+1% - 4.65%

3m SORA+1%

Package 4

Floating

-

4.25%

3m SORA+0.6% - 4.25%

3m SORA+0.6% - 4.25%

3m SORA+0.6% -

4.35%

3m SORA+0.7% - 4.35%

3m SORA+0.7%

Package 5

Floating

-

4.15%

3m SORA+0.5% - 4.15%

3m SORA+0.5% - 4.15%

3m SORA+0.5% - 4.65%

3m SORA+1% - 4.65%

3m SORA+1%

.

Financial Institutions

Years of experience

Valued Customers

Outstanding awards

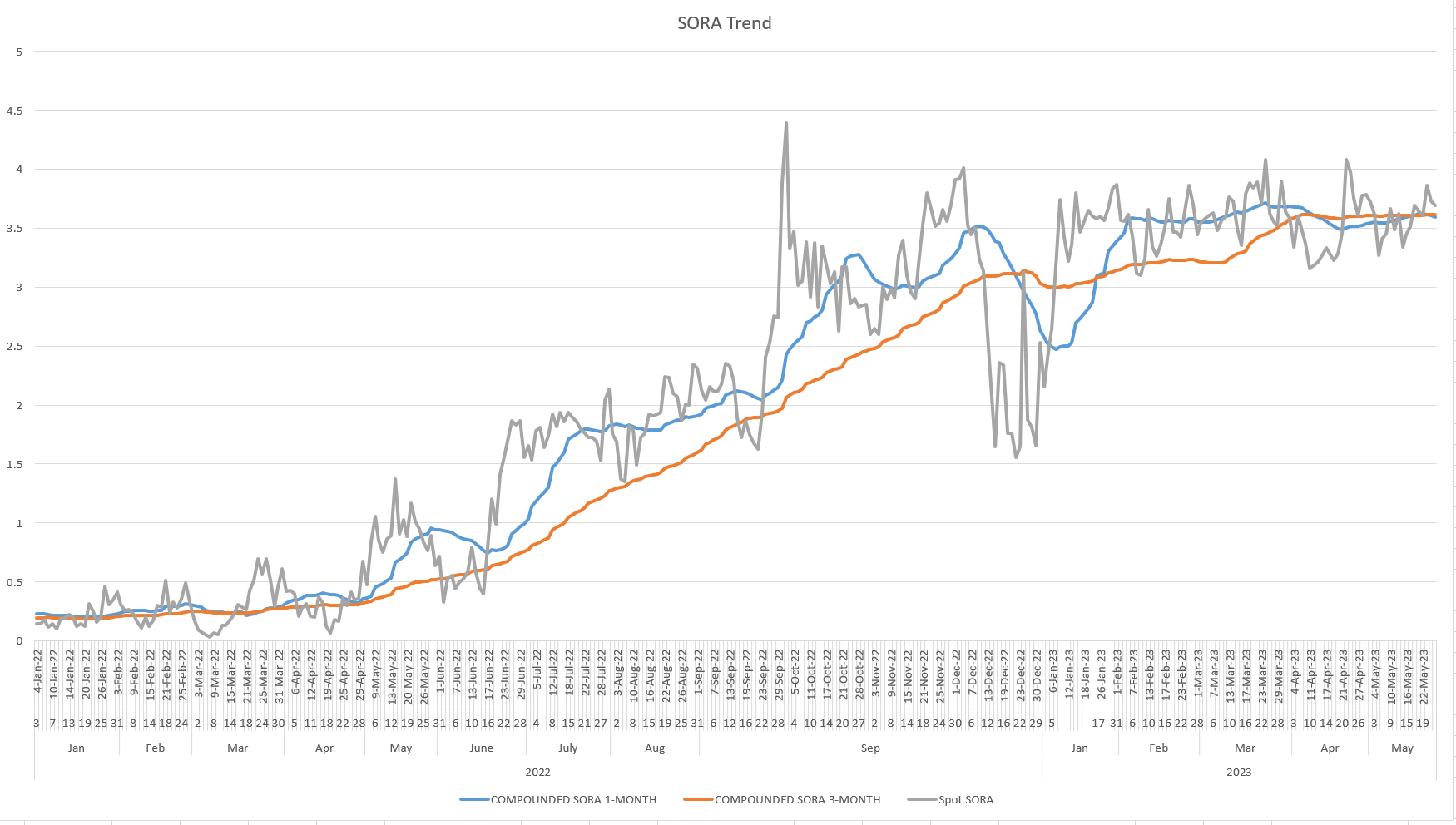

SORA Historical Trend Chart

What is SORA and how is it calculated?

SORA (which is the Singapore Overnight Rate Average) is the volume-weighted average rate of actual borrowing transactions in the unsecured overnight interbank SGD cash market in Singapore. It is administered by the Monetary Authority of Singapore (MAS), and published at 9am on the next business day in Singapore.

The phrase “volume-weighted average” sounds daunting, but it simply means that the calculations consider the actual amount being lent.

Think of it this way: when calculating SORA, the interest rate for a S$100 million transaction is 5 times more important than the interest rate on a S$20 million transaction.

Why all the fuss over SORA? Well, it is the new benchmark interest rate introduced by the MAS that will replace the Singapore Interbank Offer Rate (SIBOR) and Swap Offer Rate (SOR) when they are phased out by 2024. Even if you have an existing home loan that is pegged to the SIBOR or SOR, you will have to switch over to a SORA-based one if your loan period ends after that.